Spring has sprung and so has the housing activity across Durham Region. While inventory is climbing and prices remain steady, the pace of sales is showing signs of cooling compared to last year. Buyers have more choice than they’ve had in recent years, and sellers are adjusting to a more balanced playing field.

Let’s break down what’s really happening across the region.

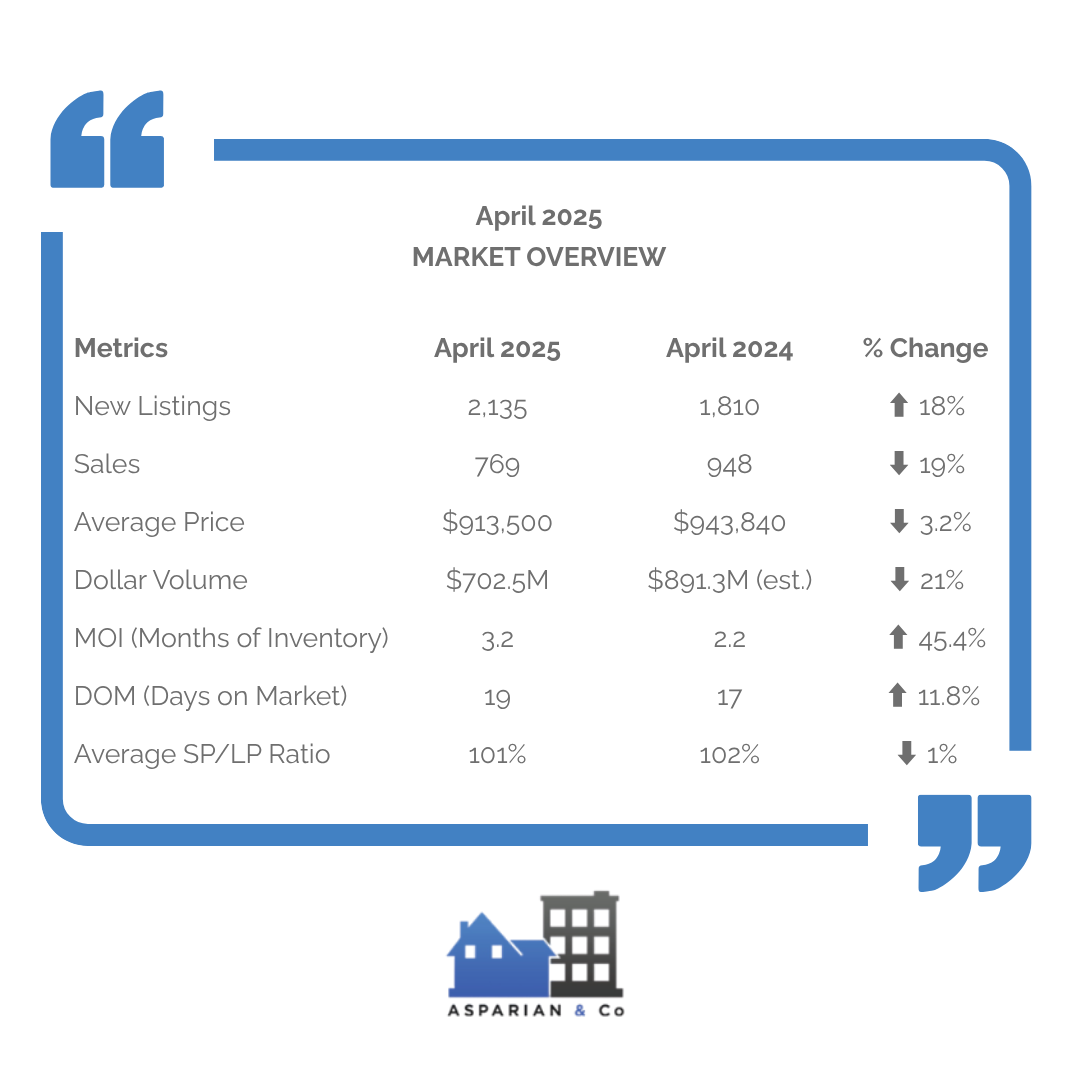

MARKET OVERVIEW

In April 2025, Durham Region's housing market showed signs of rebalancing with a 58% increase in active listings and an 18% rise in new listings compared to last year. Sales dropped 19%, and the average home price declined slightly to $913,500, down just 3.2% year-over-year. With inventory up and homes taking slightly longer to sell, the market is shifting toward more balanced conditions.

The market is shifting toward balance: more inventory, longer listing times, and slight price adjustments.

CITY-BY-CITY BREAKDOWN

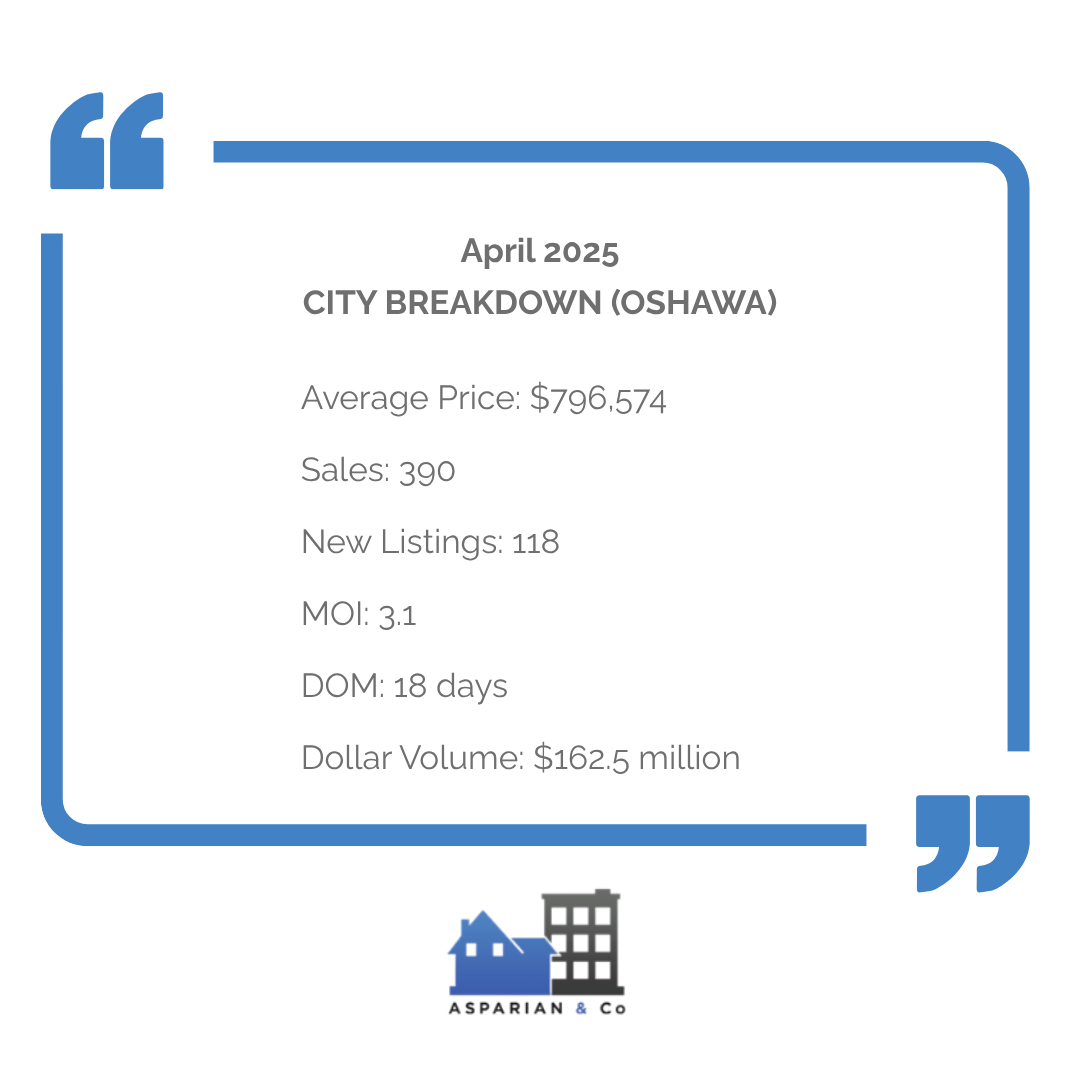

- Oshawa

Oshawa’s market softened slightly this April, with sales dropping to 204 and the average price landing at $796,574. Despite the dip in activity, new listings and active inventory both increased, offering buyers more choice while sellers still enjoyed a strong 102% sale-to-list price ratio.

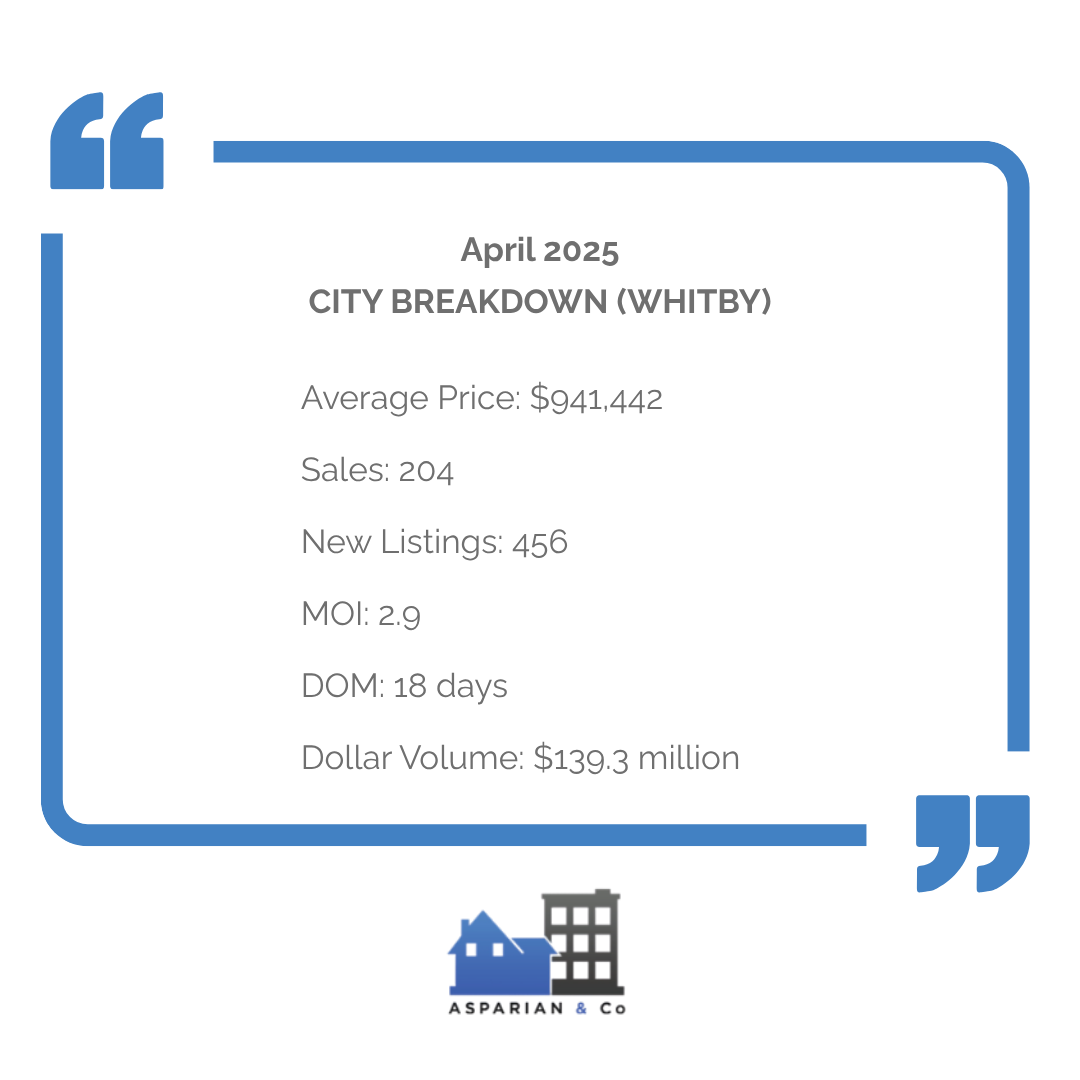

- Whitby

Whitby saw 204 homes sold in April at an average price of $941,442, down from last year’s $1.04M. While prices moderated, inventory levels rose and homes continued to sell quickly—averaging just 18 days on the market.

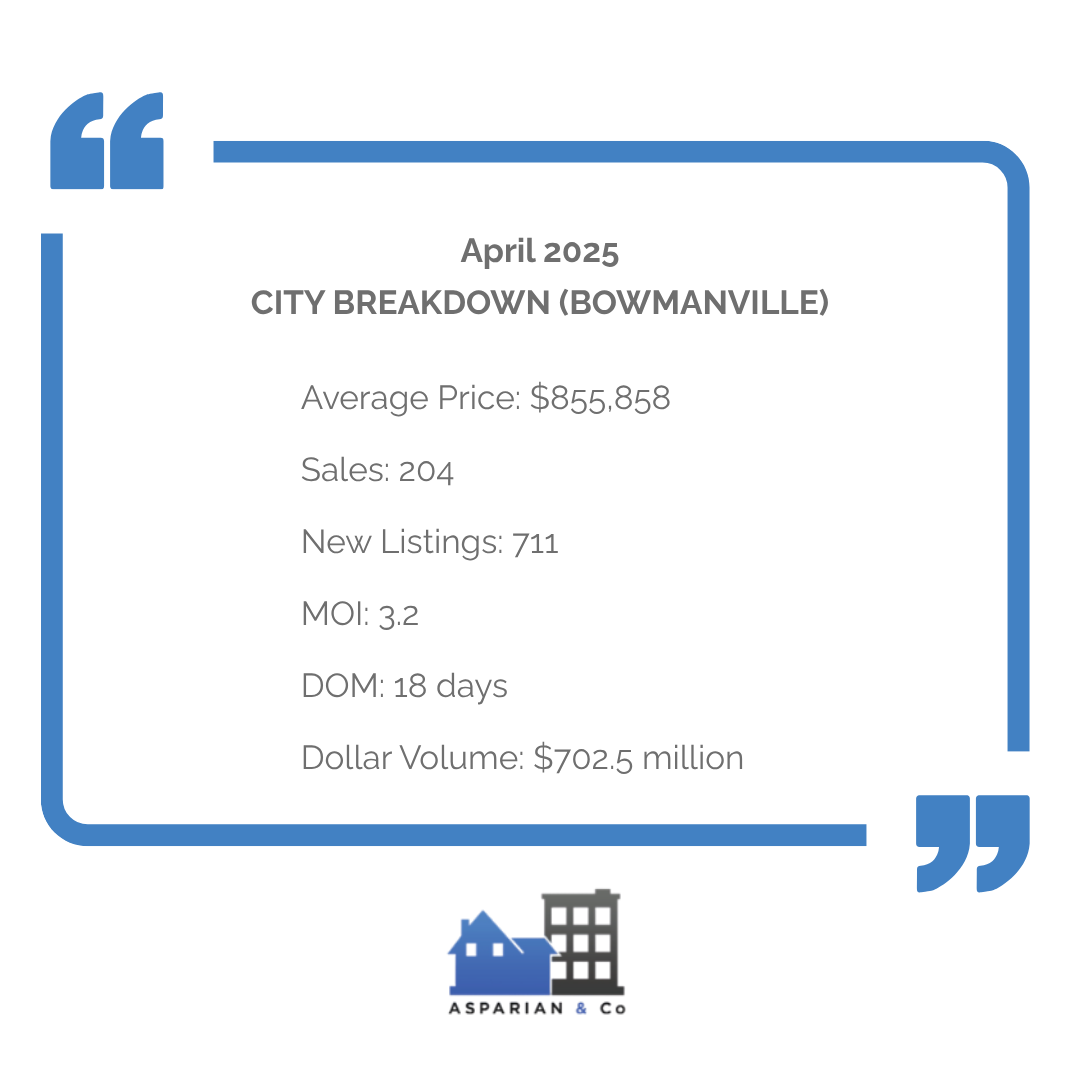

- BOWMANVILLE

Bowmanville had the highest number of new listings at 711 and matched Oshawa and Whitby in total sales (204), but with a slightly lower average price of $855,858. With months of inventory rising to 3.2 and days on market holding steady at 18, the area is showing signs of becoming more balanced between buyers and sellers.

CITY-BY-CITY COMPARISON

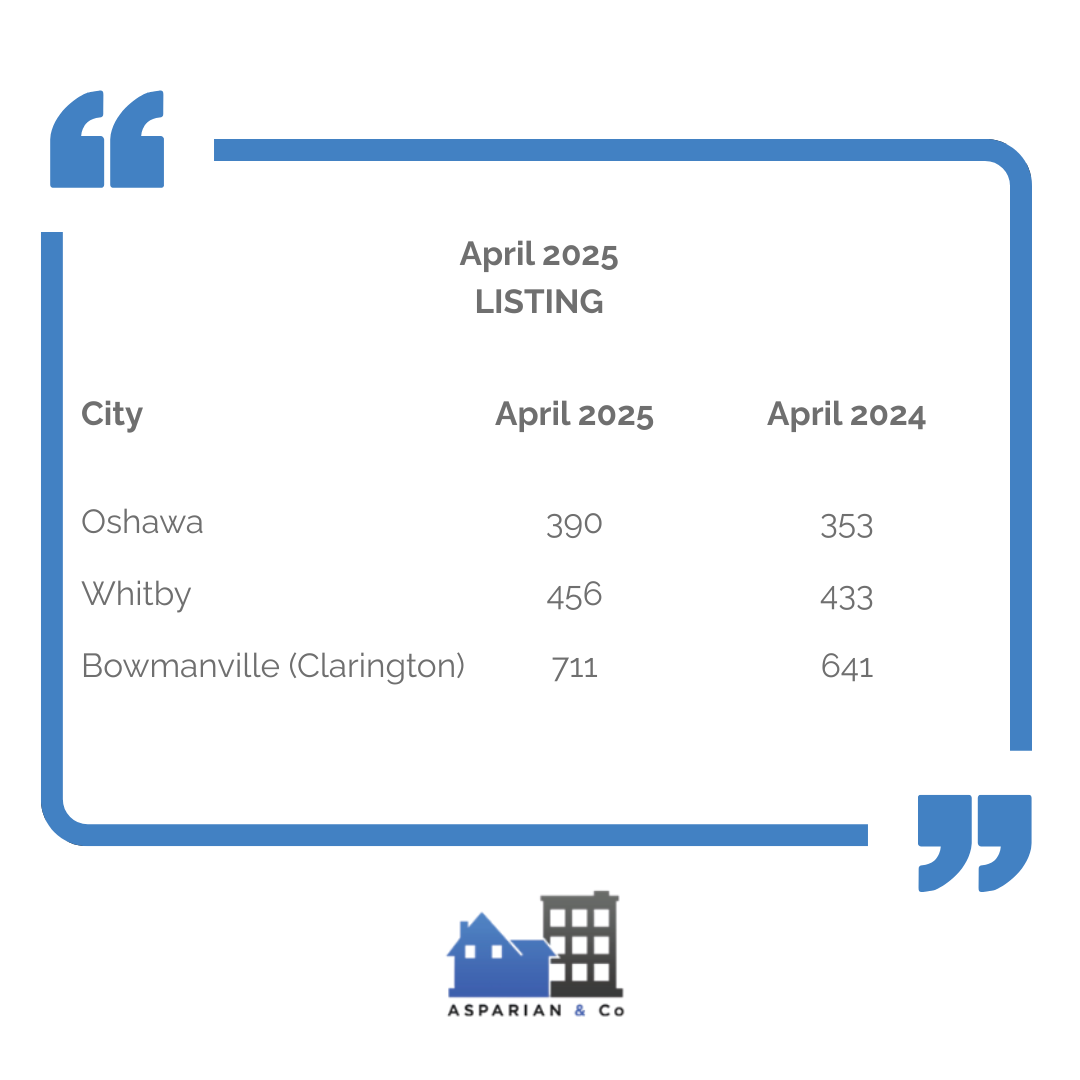

Listings Comparison

In April 2025, new listings in Oshawa, Whitby, and Bowmanville all increased compared to the same period last year. Oshawa rose from 353 to 390 listings, while Whitby saw a modest jump from 433 to 456. Bowmanville recorded the most significant increase, climbing from 641 to 711 listings—adding even more inventory to the region’s most active submarket.

Sales Comparison

In April 2025, sales activity declined across Oshawa, Whitby, and Bowmanville compared to the same time last year. Oshawa dropped from 248 to 204 sales, while Whitby declined from 273 to 204. Bowmanville also saw a slowdown, with sales falling from 280 to 204—signaling a more cautious buyer pool across the board.

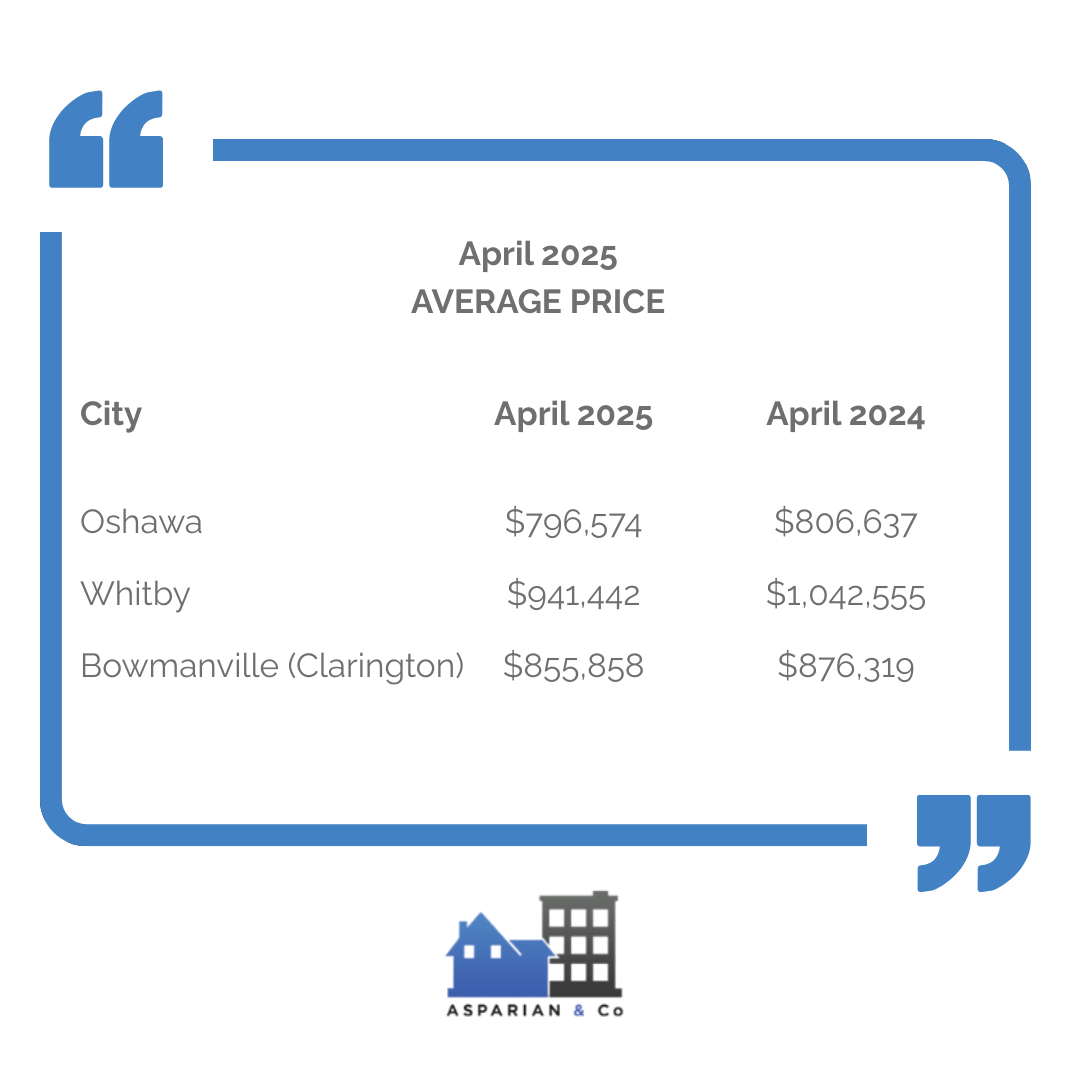

Average Price Comparison

Average home prices softened year-over-year in all three cities. Oshawa dipped slightly from $806,637 to $796,574, while Whitby declined more significantly from $1,042,555 to $941,442. Bowmanville followed with a moderate drop, falling from $876,319 to $855,858—reflecting a market where increased supply is tempering price growth.

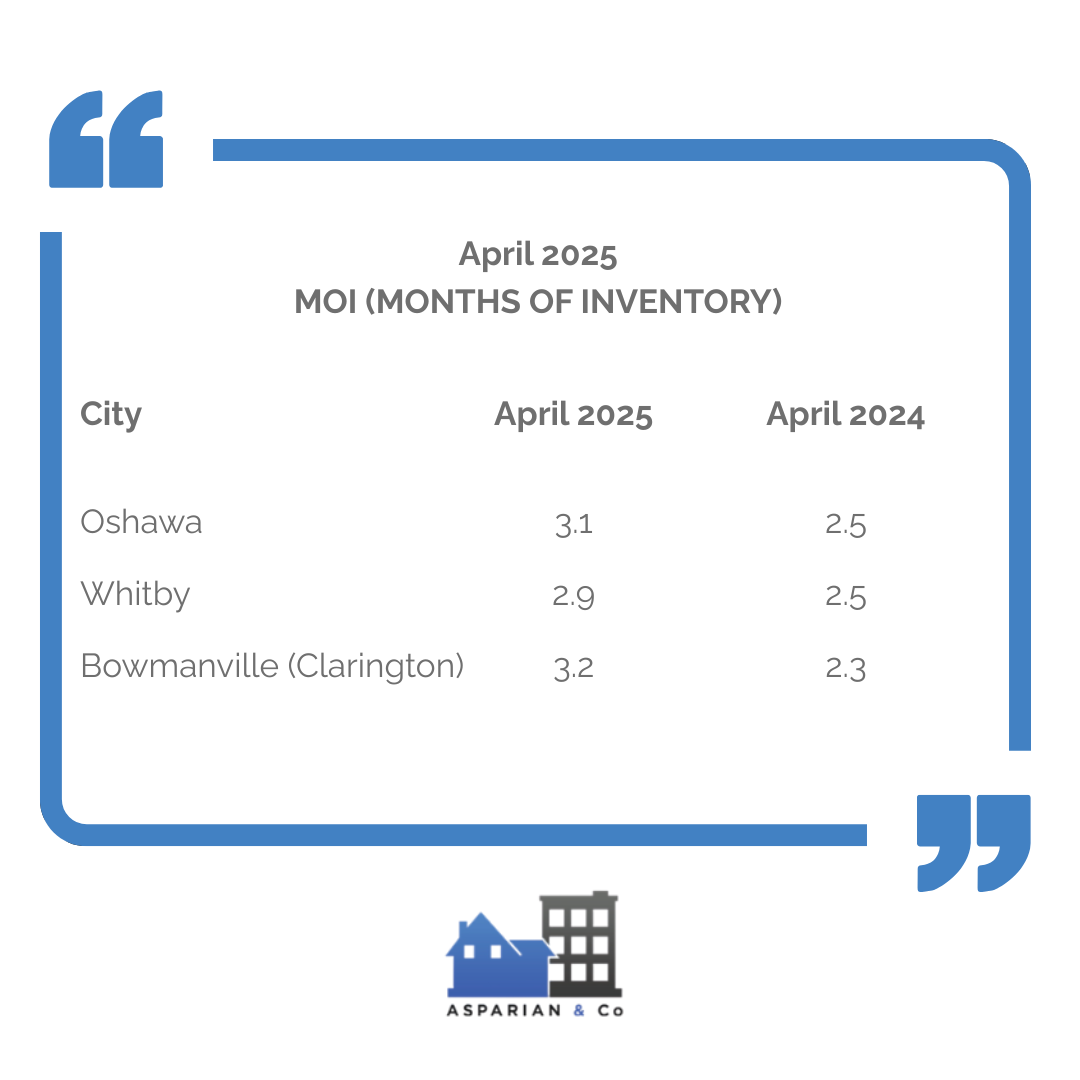

MOI (Months of Inventory) Comparison

Months of Inventory rose year-over-year in all three markets, indicating improving conditions for buyers. Oshawa moved from 2.5 to 3.1 months, and Whitby increased from 2.5 to 2.9. Bowmanville recorded the highest increase, climbing from 2.3 to 3.2—marking the closest shift toward a balanced market among the three.

Dollar Volume Comparison

Total dollar volume also declined in April 2025 compared to April 2024. Oshawa fell from an estimated $190.6 million to $162.5 million, and Whitby dropped from $177.8 million to $139.3 million. Bowmanville saw the sharpest decrease, going from $891.3 million to $702.5 million—driven by fewer sales and slightly lower prices.

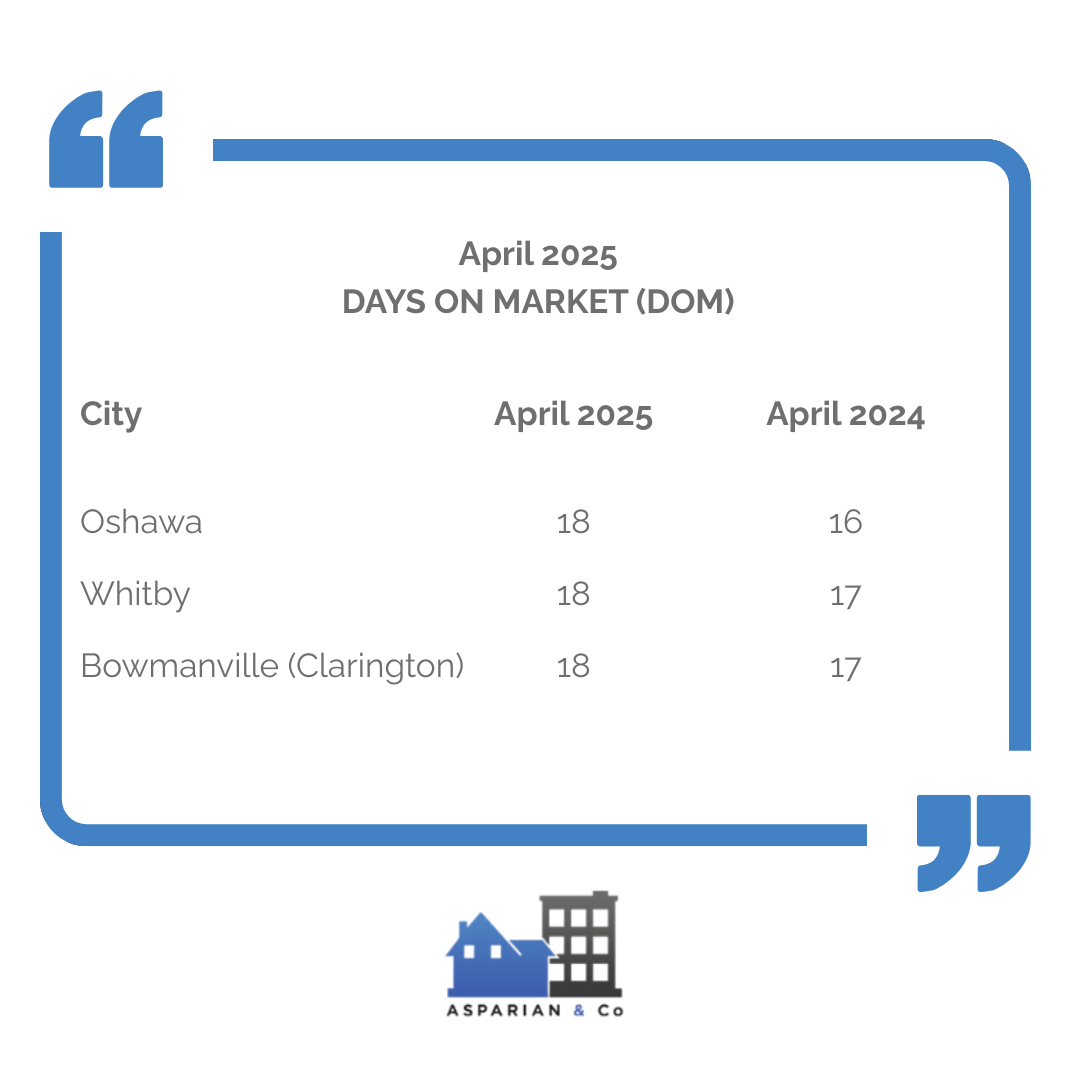

Days on Market (DOM) Comparison

Homes took slightly longer to sell in April 2025 than they did the previous year. Oshawa’s DOM increased from 16 to 18 days, while Whitby rose from 17 to 18 days. Bowmanville remained nearly steady, ticking up from 17 to 18 days—showing a subtle shift in buyer urgency.

WHAT THESE MEAN FOR BUYERS AND SELLERS

For buyers, the increase in both new and active listings means more selection and slightly less pressure. With homes staying on the market a little longer and prices stabilizing, there’s more room to negotiate—especially in areas like Bowmanville, where inventory has grown the most. While interest rates remain a factor, the current market gives buyers a chance to make more informed decisions without the frenzy of last year.

For sellers, properties are still moving at strong sale-to-list ratios, but expectations need to be adjusted. Overpricing in this market could lead to longer days on market or missed opportunities, as buyers now have alternatives. Sellers who invest in preparation and pricing strategically can still take advantage of solid demand—especially in mid-range and move-in-ready segments.

WHAT APRIL 2025 REVEALS ABOUT THE DURHAM REGION MARKET

The Durham Region real estate market in April 2025 is showing continued signs of moderation as the gap between supply and demand begins to widen. While average prices in Oshawa, Whitby, and Bowmanville have dipped slightly compared to the previous year, the more notable trend is the sharp rise in new and active listings paired with a decline in sales. This shift suggests that both buyers and sellers are approaching the market with greater caution, likely influenced by lingering economic uncertainty and interest rate sensitivity. Even so, properties are still selling at solid prices, with sale-to-list ratios remaining around 102%, showing that demand is still present—especially for well-priced and move-in-ready homes.

Bowmanville (Clarington) continues to lead in inventory growth, offering buyers more choice while maintaining competitive pricing. Although total dollar volumes declined across all three cities, the drop reflects fewer sales rather than a collapse in value. With homes taking slightly longer to sell and Months of Inventory increasing, buyers now have more time to consider their options without the urgency of previous years. For sellers, this evolving landscape calls for a strategic approach—homes that are well-prepared and priced in line with current conditions can still attract strong offers. The market may be shifting, but opportunity remains on both sides of the transaction.

Need help navigating this market?

Reach out today to book a free strategy session tailored to your real estate goals. Contact Us!