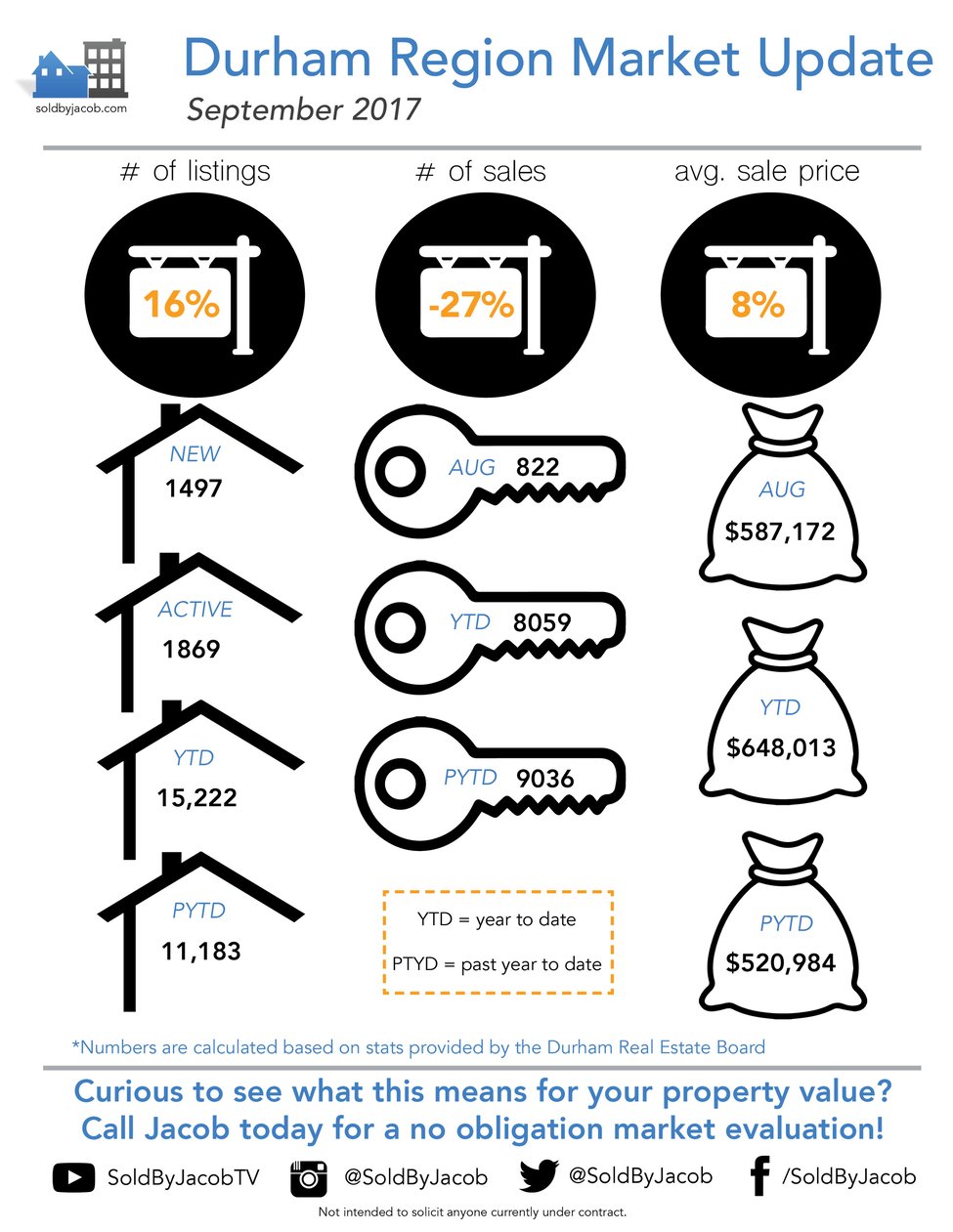

It’s that time again - your monthly market update as of August 2017! Just like last month, we continue to see things cooling down and balancing out, and it appears that home buyers now have much more choice as there is more and more inventory available across Durham Region. This change is especially welcome for first time buyers and those who may have been forced to compete in multiple offer situations in the past. In August, there was 16% more new listings from the same time last year, however, the overall number of sales is down by 27%.

The average selling price has seen an increase of 8% from this time last year.

What does this mean for your specific area?

Here’s a breakdown of Durham Region:

Pickering has seen a 17% increase in average selling price. Listings are up 31%, however, sales are down 25%.

Ajax has seen a 1% decrease in the number of listings, as well as a 28% decrease in the number of sales. The average selling price is 9% higher than last year.

Whitby saw a 18% decrease in the number of listings as compared to last year, but a 30% decrease in the number of sales. The average selling price increased by 17%.

Clarington had a 38% increase in the number of listings. There was a 25% decrease in the number of sales, and the average selling price has increased by 1%.

Oshawa experienced a 19% increase in the number of listings, but a 26% decrease in the number of sales. The average selling price increased by 3%.

It’s important to remember that there are rare pockets within each city that will have their own unique numbers that may not reflect what we have reviewed. To find out what your property is worth, it’s always a good idea to have a professional realtor give you a current market evaluation. Factors such as the property condition, upgrades, and proximity to vital services and amenities to give you an accurate value.

If you’re interested in learning what your home is worth, don’t hesitate to contact Jacob for a confidential, no-obligation market evaluation.

- Submenu for Blog Details

- Home

- Communities

- Sellers

- Buyers

- Map Search

- New Builds

- Blogs

- Contact

- About